Delivering strong, stable returns in a $44B growth industry

The Vital Self-Storage Sector

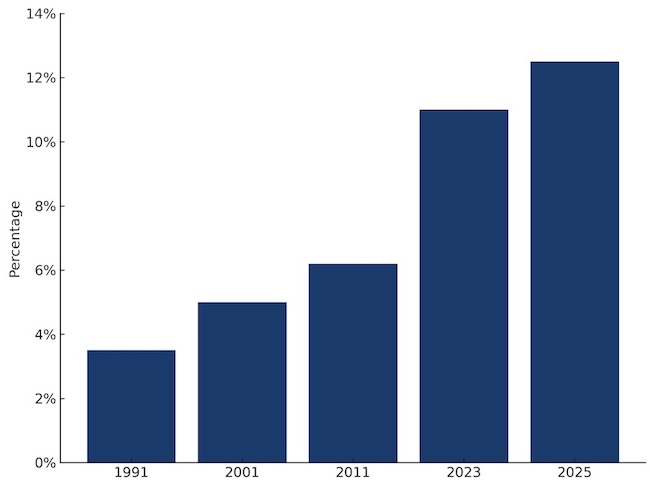

Self-storage performance over the last three decades has been consistently impressive, averaging annual returns of 17.26%. Unlike other asset classes, the self-storage industry is highly fragmented, with the public REITs owning less than 40% of the market. That leaves the majority of properties in the hands of smaller operators, creating tremendous acquisition potential when compared to other real estate asset classes.

"Self-storage was the best-performing sector during the COVID pandemic, delivering almost 43% total returns."

Interview with John Worth, EVP Nariet,

WealthManagement.com, January 9, 2023

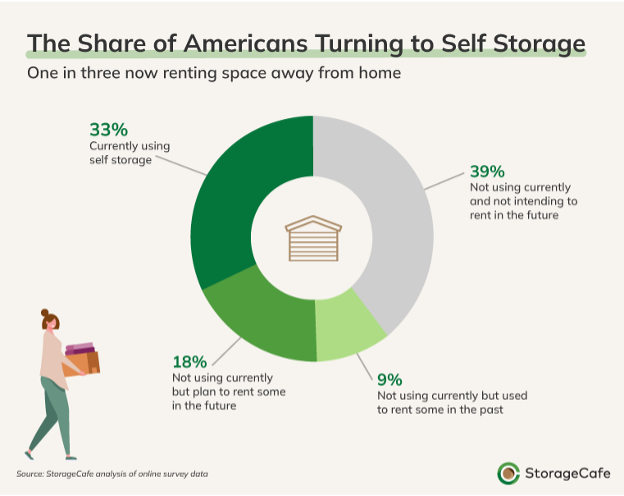

Self-Storage Usage: Strong and Growing

The self-storage industry benefits from smaller living spaces, demographic shifts, and flexible work environments.

- Space limitations: Apartments have decreased in size, especially in densely populated urban and suburban areas, pushing residents to use storage. In southern markets basements are rare.

- Lifestyle transitions: Self-storage demand correlates with household movement, often related to the "4 Ds": death, divorce, downsizing, and dislocation.

- Demographic changes: Multiple generations are fueling self-storage growth.

- Baby boomers are downsizing from larger family homes.

- Millennials are frequent users during transitional life phases, such as moving for job opportunities or starting families.

- Generation Z is the fastest growing market, with many young people moving for school or work and living in small spaces.

Sources: U.S. Census Bureau; Public Storage (PSA) company reports; Sparefoot; Yardi Matrix

Source: StorageCafe

- Remote work: Remote and hybrid work has led many people to convert living spaces into home offices, with no room for extra furniture and personal items.

- Growth of e-commerce: Many small businesses, online retailers, and contractors use storage units as an affordable alternative to more expensive commercial warehouse space for storing inventory, equipment, and supplies.

Source: StorageCafe

Join Our Investor Network